MSCI is considering a reclassification of Pakistani Equity market from Frontier to Emerging market status on 14th June 2016.

MSCI – A leading provider of research-based indexes and analytics, announced today that it will release on June 14, 2016, shortly after 11:00 p.m. Central European Summer Time (CEST), the results of the 2016 Annual Market Classification Review. As a reminder, three MSCI Country Indexes are currently included on the review list of the 2016 Annual Market Classification Review: MSCI China A and MSCI Pakistan Indexes for a potential reclassification to Emerging Markets and MSCI Peru Index for a potential reclassification to Frontier Markets.

It is important to note that MSCI is not the only index provider that classifies markets – but is considered the reference benchmark for many markets. MSCI and other index providers base their market classification on a number of quantitative measurable and comparative criteria while aiming to avoid qualitative and/ or subjective criteria.

PAKISTAN: ECONOMY IN FOCUS

Pakistan is a country with a population of 190 million people. Pakistan’s GDP stands at USD 250 Billion (Year 2015). Pakistan’s economy continued to pick up in the Fiscal Year 2015 as economic reform progressed and security improved. Inflation markedly declined, and the current deficit narrowed with favourable prices for oil and other commodities. Despite global headwinds, the outlook is for continued moderate growth as structural and macroeconomic reforms deepens.

| Selected economic indicators (%) – Pakistan | 2015 | 2016 Forecast | 2017 Forecast |

| GDP Growth | 4.2 | 4.5 | 4.8 |

| Inflation | 4.5 | 3.2 | 4.5 |

| Current Account Balance (share of GDP) | -1.0 | -1.0 | -1.2 |

CPEC : THE GAME CHANGER FOR PAKISTAN

China Pakistan economic corridor (CPEC) is a mega project of USD 46+ Billion taking the bilateral relationship between Pakistan and China to new heights. The project is the beginning of a journey of prosperity of Pakistan and China’s Xinjiang. The economic corridor is about 3000 Kilometers long consisting of Highways, Railways and Pipelines that will connect China’s Xinjiang province to the rest of the world through Pakistan’s Gwador port.

The investment on the corridor will transform Pakistan into a regional economic hub. The corridor will be a confidence booster for investors and attract investment not only from China but other parts of the world as well. Other than transportation infrastructure, the economic corridor will provide Pakistan with the telecommunications and energy infrastructure.

MSCI INDICES & PAKISTAN – A QUICK RECAP.

It is important to mention that Between 1994- 2008 Pakistan was part of the MSCI Emerging Markets Index. After the Balance of Payment crisis in 2008, KSE was shut down for 4 months after which the country was kicked out of the Emerging Markets Index. In May 2009 Pakistan was added back in the MSCI Index, but this time it was added in the Frontier Markets Index.

June last year MSCI put Pakistan up for official review regarding inclusion into Emerging Markets. Now as per today’s Press release MSCI will make its decision whether to upgrade or not on 14th of June.

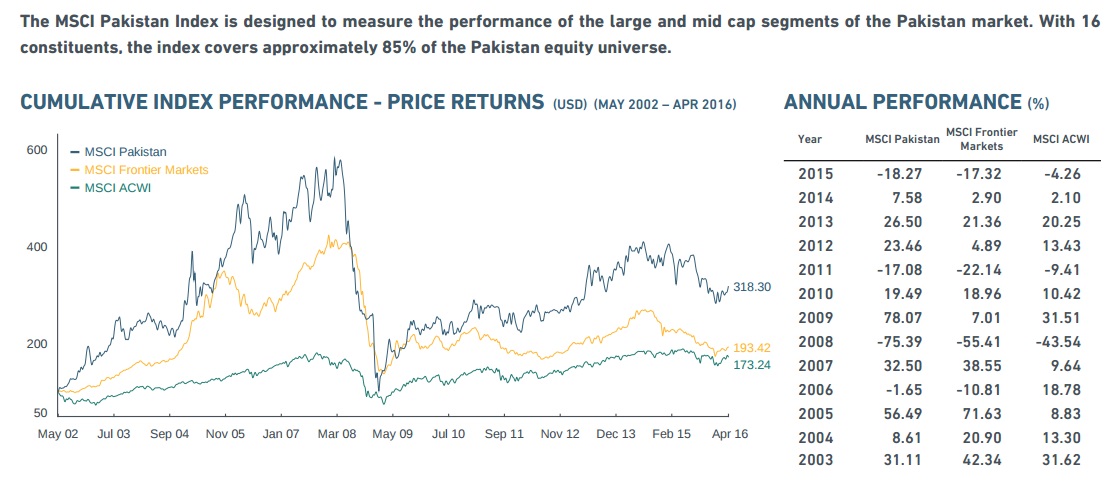

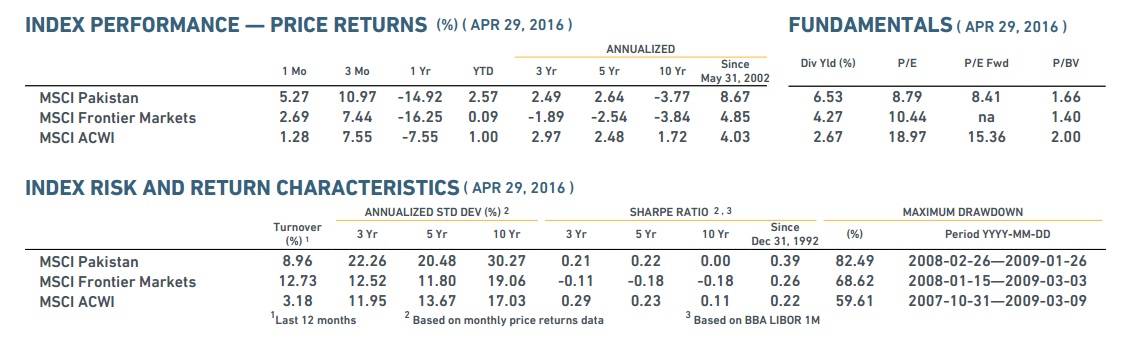

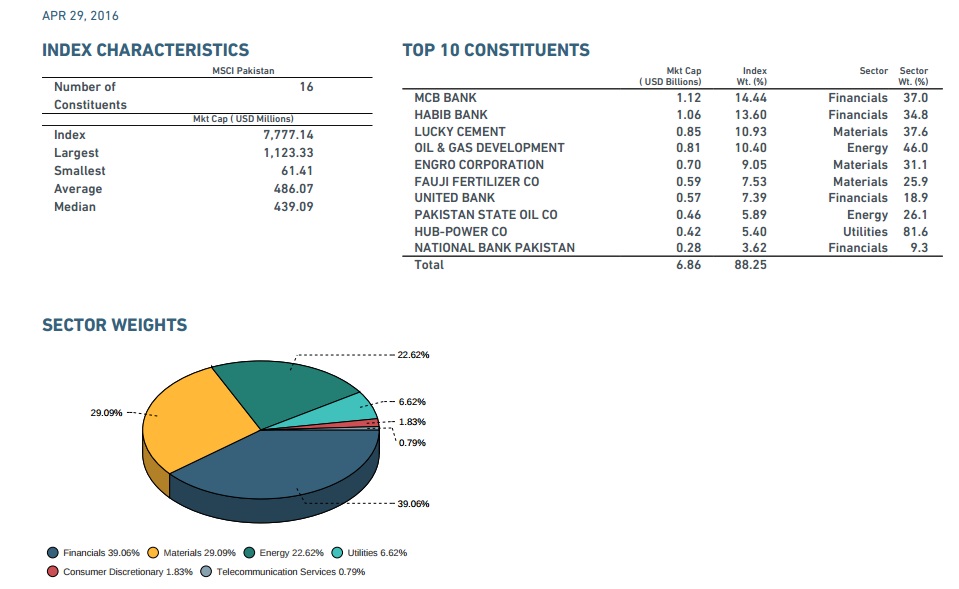

RECAP : THE MSCI PAKISTAN INDEX

INDEX METHODOLOGY:

The index is based on the MSCI Global Investable Indexes (GIMI) Methodology—a comprehensive and consistent approach to index construction that allows for meaningful global views and cross regional comparisons across all market capitalization size, sector and style segments and combinations. This methodology aims to provide exhaustive coverage of the relevant investment opportunity set with a strong emphasis on index liquidity, investability and replicability. The index is reviewed quarterly—in February, May, August and November—with the objective of reflecting change in the underlying equity markets in a timely manner, while limiting undue index turnover. During the May and November semi-annual index reviews, the index is rebalanced and the large and mid capitalization cutoff points are recalculated.

SOME IMPORTANT NUMBERS/STATS:

WHAT TO LOOK FOR IF PAKISTAN ENTERS MSCI EMERGING MARKETS INDEX ?

If the decision is positive Emerging Markets funds with 40-50 times the capital of Frontier funds will be forced to have a look at Pakistan. In our view this is an opportunity with a risk-reward skewed heavily towards the positive side.

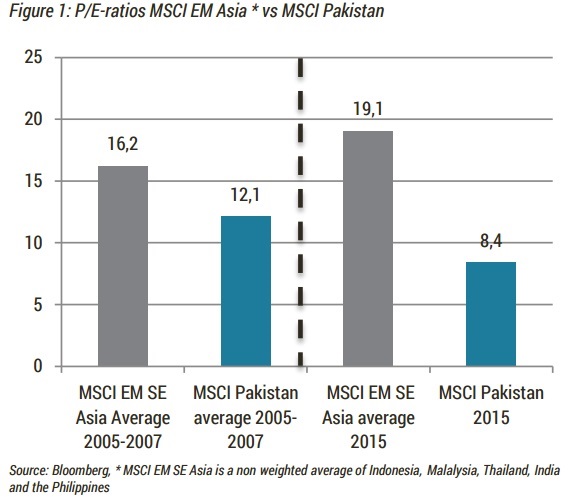

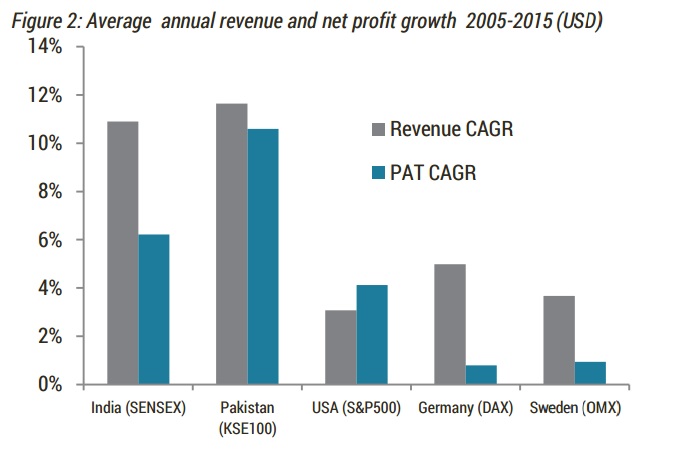

PSX currently trades at 9.0x earnings, companies have grown faster than their regional peers in USD over the last ten years. Should Pakistan enter MSCI Emerging Markets it does so at more than 40% P/E-discounts to its Asian EM peers. We don’t believe this is sustainable, hence calls for a re-rating of the valuations.

OUR STANCE:

We are of the view that it is likely that Pakistan will be given a Green Signal for entering MSCI Emerging Markets on 14th June 2016.

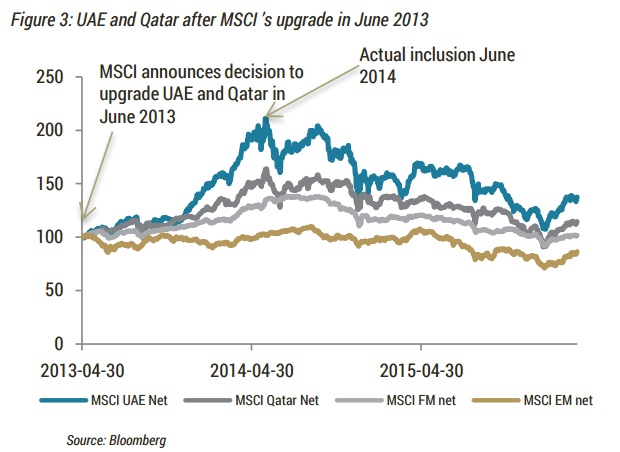

We caution against the notion that reclassification is a panacea for market ills or under-performance. Typically, reclassification (both upgrades and downgrades) have followed or been accompanied by economic and financial policy reforms, including improvements in market infrastructure. It is these more fundamental and structural reforms that attract and retain international investors and boost the confidence of domestic investors.

Re-classifications are best viewed as signaling a confirmation of policy reforms and changes in market conditions. Hence an identification problem may arise whereby improved market conditions are attributed to market reclassification decisions, whereas they are due to policy actions and reforms which lead to a reclassification. Similarly, we note that reclassification may have perverse effects if there is an ‘overshooting‘ effect whereby speculation leads to higher prices in advance of a reclassification, over and above what would be justified by market/ economic fundamentals. Prices then adjust on the actual reclassification event.

As highlighted in the article Average Annual Revenue and Net Profit Growth of companies listed in Pakistan have been phenomenal between Year 2005 – 2015. Moving forward with CPEC in place, Pakistan’s inclusion in MSCI Emerging Markets Index will be beneficial for both Local as well as Global Investors.

Research Team,

SFS Global Services.